Lawsuit alleges BigBear.ai committed securities fraud with misstatements

A lawsuit has been filed against BigBear.ai Holdings and multiple senior executives over allegations of securities fraud.

BigBear merged with GigCapital4 Merger Sub Corporation and GigCapital4 Inc. in 2021, and then issued $200 million in unsecured convertible notes maturing in December, 2026. Those notes were not properly accounted for in company financial statements, plaintiffs allege.

BigBear then went public via a special purpose acquisition company (SPAC) transaction.

The company’s stock declined by 15 percent from March 17 to March 18 of this year, when it announced that financial statements since 2021 will have to be restated. On March 25, the company refiled its financial statements and said it had identified a material weakness in its financial reporting controls. The stock price had recovered beyond its March 17 closing price, but fell 9 percent on this news.

The suit Priewe v. BigBear.ai Holdings, Inc., et al., No. 25-cv-00623, has been filed in the Eastern District of Virginia, with Bleichmar Fonti & Auld LLP representing the named plaintiff.

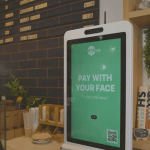

BigBear acquired Pangiam in 2023 to “create a full-vision AI portfolio” after Pangiam had acquired face biometrics developers veriScan and Trueface in 2021.

Comments